The global equity markets have continued their decline, which began on February 20, in response to fears over the COVID-19 (coronavirus) becoming a global pandemic. The S&P 500 Index fell -12.0% from February 20-27 and is on pace for another decline on February 28. International equity markets have fared better, with the MSCI EAFE and MSCI Emerging Markets indices declining -7.4% and -6.6%, respectively. The last six days has been the fastest correction (10% drawdown) on record for the S&P 500 off an all-time high, which has likely exacerbated market fears. With the drawdown, the markets are pricing in significant earnings declines as a result of the virus, and certainly weaker global economic activity.

COVID-19

- Globally, there are now over 83,000 confirmed cases of COVID-19, with over 2,800 reported deaths and over 36,000 confirmed recoveries. While new confirmed cases overall have slowed substantially in the last two weeks, new confirmed cases outside of China have grown (Source: Johns Hopkins, CSSE).

- Headlines continue to focus on the spread of the virus; however, the number of new recovered cases has exceeded the number of new confirmed cases for each of the last 10 days (Source: Johns Hopkins, CSSE).

- The mortality rate is clearly elevated by age and the presence of preexisting conditions. Estimated mortality rates for individuals younger than 50 years of age and/or those with no pre-existing conditions are well below 2%, and close to 0% for people below the age of 40 (Source: Chinese Center for Disease Control and Prevention).

- Mortality rates outside of China may be lower. The virus has a greater impact on individuals with compromised lung capacity, and China has lower air quality and higher rate of smoking than most of the rest of the world (Source: Yale Environmental Health Index, Global Health Data Exchange).

- The intermediate-term market trend remains solid, and in the short-term, markets look to be near-term oversold. The percentage of oversold names in the S&P 500 Index is now the fourth highest since 1957, and these deep oversold conditions have historically created strong forward returns (Source: Renaissance Macro Research).

- US equity markets have very quickly gone from over-valued to fairly-valued, and with the forward P/E ratio of the S&P 500 at 16x, it is now below its 25-year average of 16.7x (Source: JPMorgan Guide to the Markets). This correction has likely washed out investors who were overleveraged to US stocks coming into 2020.

- Credit markets have also shown signs of weakness; however, they have not reacted as sharply as equity markets. Spreads on BBB-rated and high yield debt have risen, but both remain below levels we experienced in the beginning of 2019.

- Treasury yields have fallen meaningfully in the flight to quality. The yield on the 10-year Treasury note has fallen to a record-low 1.15%, while the yield on the 30-year bond is at 1.65%. We’re seeing 10-year sovereign debt in areas of Europe back in negative territory. The spread between the 2-year and 10-year treasuries—a strong recession signal—has widened in the last week, which typically portends accelerating economic growth.

We expect COVID-19 fears to continue to cause additional market volatility, but it is too early to assess the ultimate impact of the virus on economic activity and corporate earnings. Weaker global growth does not often mean a recession in the US, and the consumer remains a strong factor arguing against a US recession. Lower rates may also serve to further boost the housing market. In addition, manufacturing and wholesaling inventories are at high levels in the US, which could help mitigate supply chain disruptions from Asia. More accommodative monetary policy, which obviously cannot help the public health situation, could serve to calm financial markets and minimize the economic and psychological impacts. With inflation low, the Fed maintains flexibility to act if necessary, and we expect global central banks are prepared to act if the situation worsens.

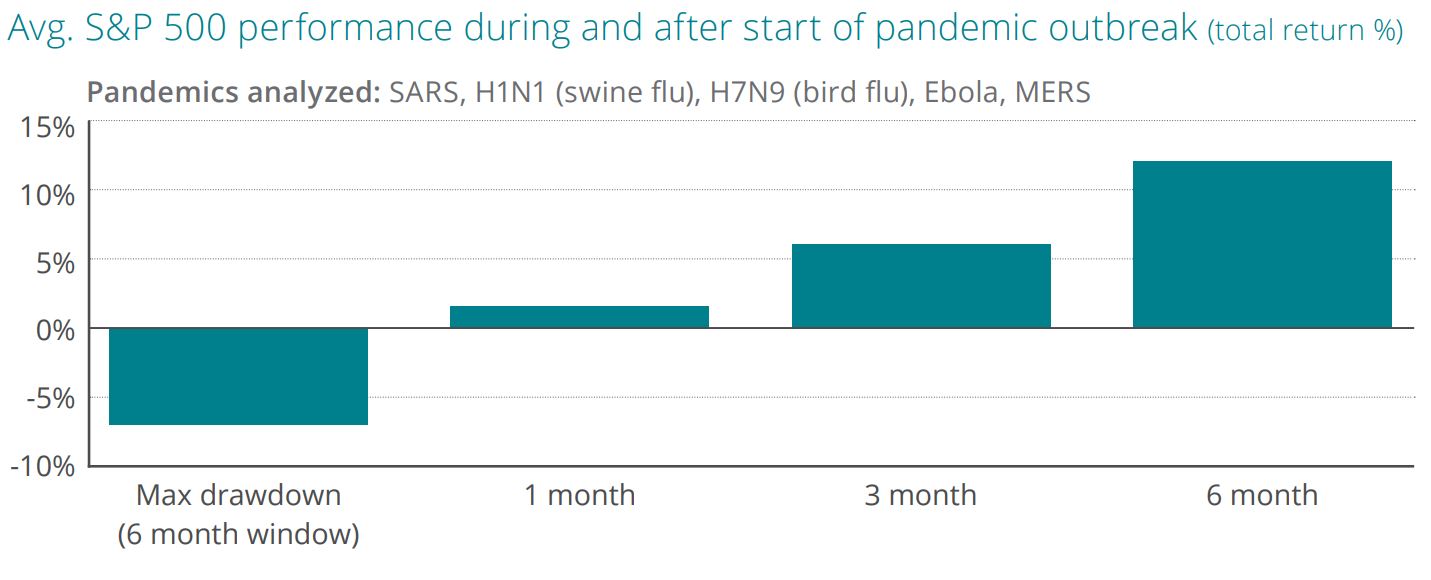

Large selloffs in the S&P 500 have historically been followed by a rebound within six months if we don’t experience a recession, which is not our expectation given the strength of the US consumer. In the history of pandemics (SARS, swine flu, bird flu, Ebola, MERS) equity markets tend to follow a similar pattern—a sharp decline followed by a recovery. As a society, we don’t know enough about COVID-19 to understand how pervasive it will become and how long and deeply it will impact markets. From a financial perspective, we do know it’s important to maintain a diversified portfolio for times like this, and in panicked environments, it is imperative to keep a level head rather than simply just react. Our intermediate term outlook remains positive.