To say investors have had a few things vying for their attention these past few weeks might be the understatement of our brand new year. Consider that so far in January we have seen the market consistently hit all-time highs; the US and Iran approach the brink of war; the Phase 1 US/China trade agreement signed; the “New NAFTA” or USMCA pass the Senate, and that same Senate launch the impeachment trial of President Trump. It’s enough to make one’s head spin. But, as always, if we are to invest successfully we must keep our focus on what really matters; and in that spirit, we see three big ideas worthy of our focus as we move deeper into the new year:

1. The US economic expansion and bull market are intact – We see none of the excesses that tend to be present late in an economic or market cycle. Concerning the former, inflation is low and the US consumer isn’t over-levered; concerning the latter, valuation is elevated but not unreasonable, and in 2019 investors pulled a record $135 billion out of US equity funds, not the behavior one expects to see at a bull market top. Most importantly, monetary policy and fiscal policy remain very supportive of growth and risk assets. We should remain bullish.

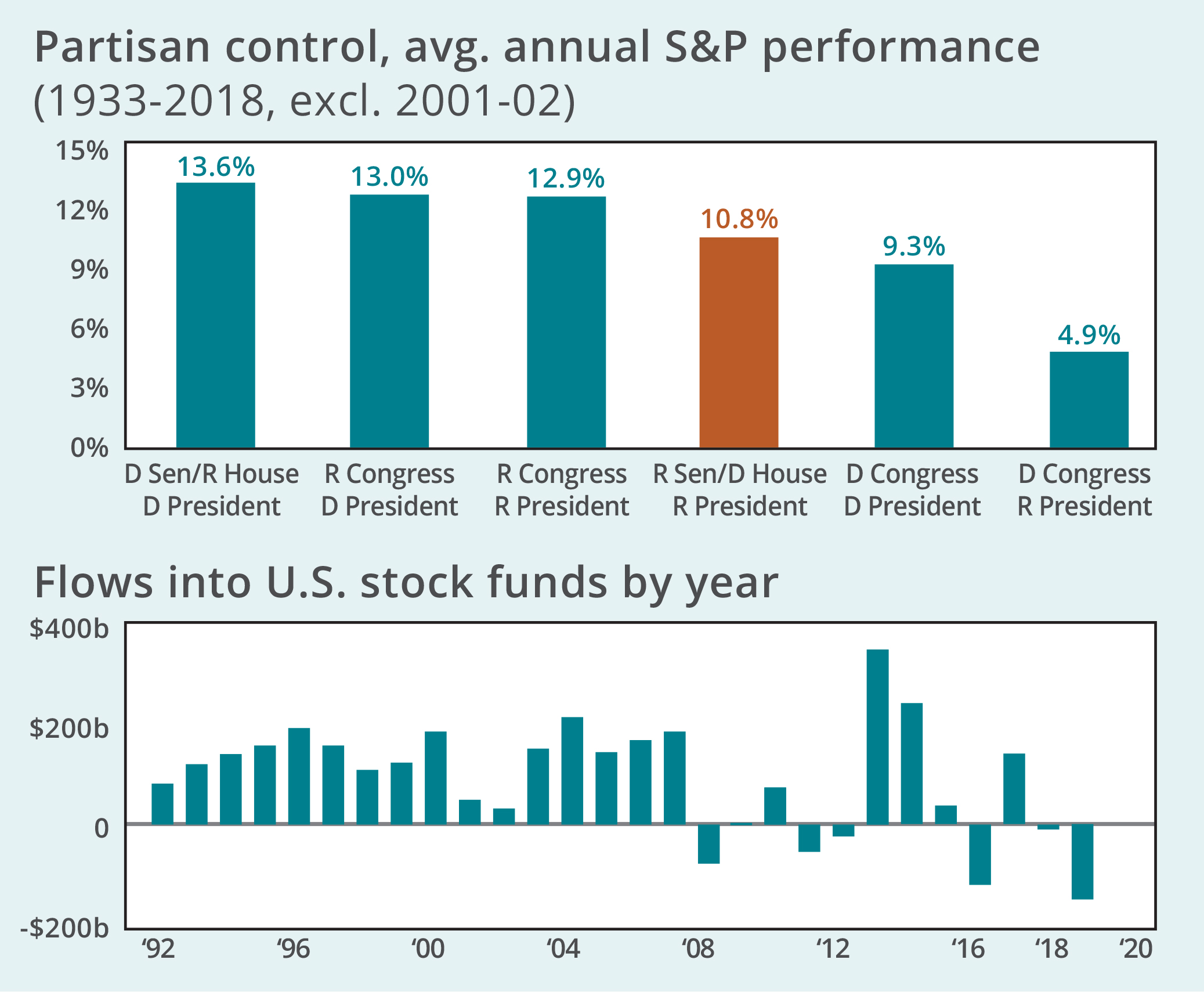

2. Ignore politics – Markets don’t give a hoot about politics, instead caring only about monetary and fiscal policy and fundamentals. Consider during the Watergate years the S&P 500 Index sold off 30% but during the Whitewater/Lewinsky years the S&P 500 rallied 20%. If markets cared about politics – including a Constitutional crisis – we would have seen comparable return streams during those two time periods, but we didn’t. Policy and fundamentals weighed on growth and risk assets during the Watergate years and supported growth and risk assets during the Whitewater/Lewinsky years and markets responded accordingly. Impeachment and the election will have no meaningful impact on the economy and market. Politics only becomes an issue if it leads to changes in policy. Our base case is that the President is acquitted and wins reelection, while the Democrats hold the House and the Republicans hold the Senate. Maintaining the political status quo in Washington, DC should bode well for the market.

3. The rest of the world looks really interesting – While we remain optimistic on the US economy and US risk assets, markets outside the US look increasingly attractive. At a high level, they have badly lagged ours; valuation is supportive and investors are under-allocated to non-US risk assets. We think the US/China trade dust-up weighed on global growth and risk assets and lifted the US dollar - a strong US dollar is a significant headwind for non-US stocks and bonds. With trade solved for, the global economy and global markets should be biased higher, and the US dollar biased lower. We should look to opportunistically increase non-US market exposure.

The views expressed are those of Brinker Capital and are not intended as investment advice or recommendation. For informational purposes only. Brinker Capital, Inc., a registered investment advisor.Tagged: Tim Holland, weekly wire, market perspectives, US/China trade, US economic growth, politics, US dollar, S&P 500